How To Calculate Compound Interest On A Loan Monthly Info Loans

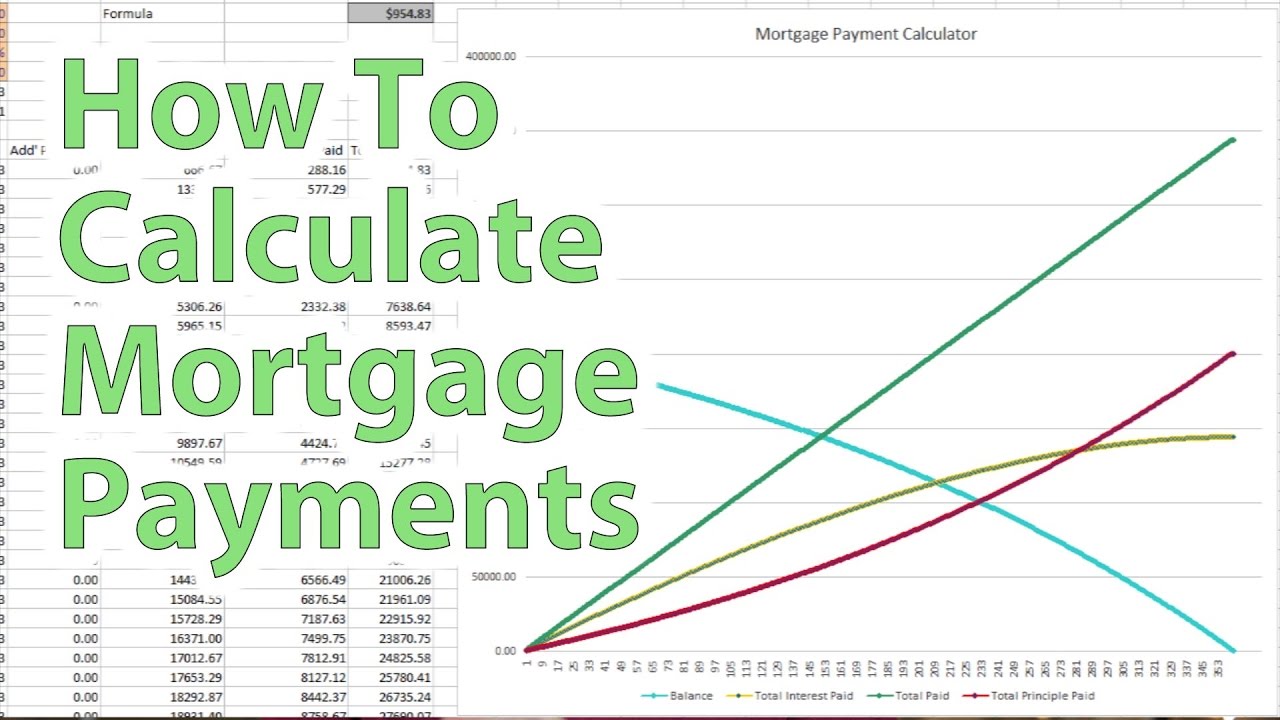

How To Calculate The Monthly Interest and Principal on a Mortgage Loan Payment YouTube

To use the mortgage amortization calculator, follow these steps: Enter your loan amount. In the Loan amount field, input the amount of money you're borrowing for your mortgage. Enter your loan.

How To Find Out Interest Rate Plantforce21

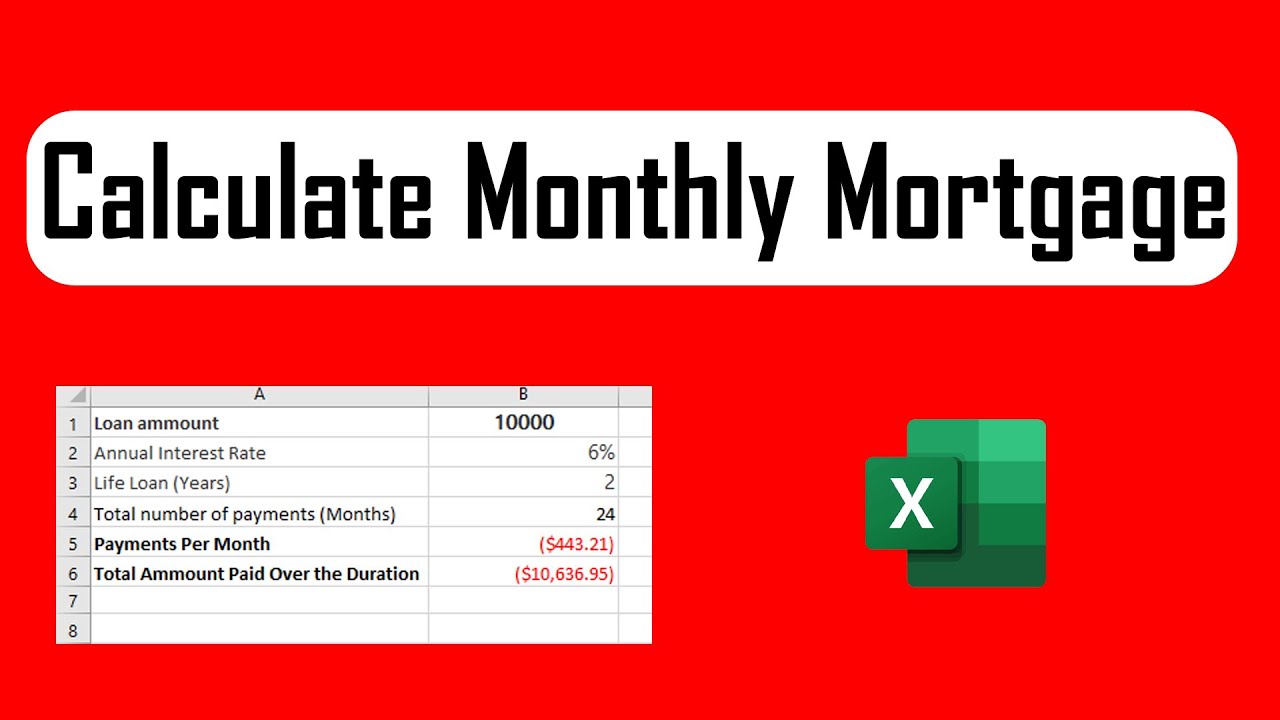

Monthly Payment Calculation. Monthly mortgage payments are calculated using the following formula: P M T = P V i ( 1 + i) n ( 1 + i) n − 1. where n = is the term in number of months, PMT = monthly payment, i = monthly interest rate as a decimal (interest rate per year divided by 100 divided by 12), and PV = mortgage amount ( present value.

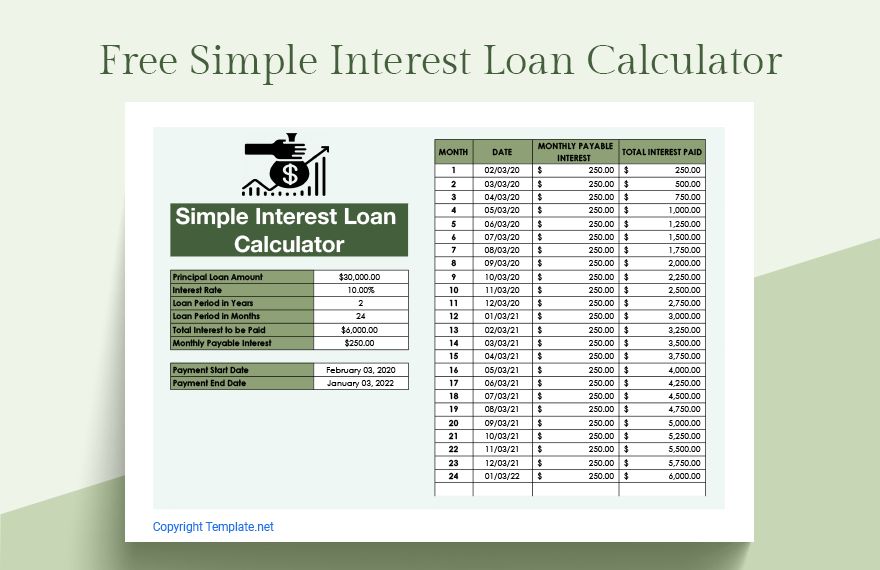

How To Calculate Simple Interest Loan Payments

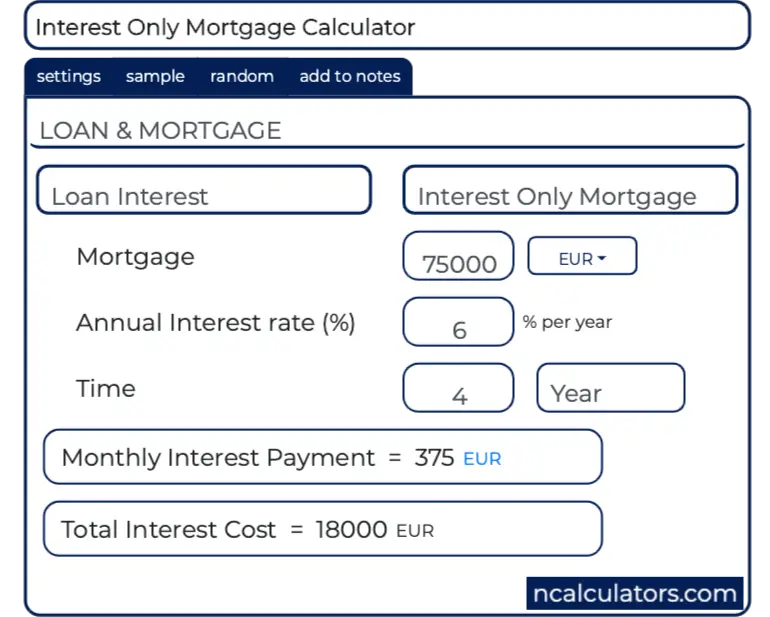

You can calculate your total interest by using this formula: Principal loan amount x interest rate x loan term = interest. For example, if you take out a five-year loan for $20,000 and the.

How to Calculate Mortgage Payments YouTube

Total monthly mortgage payment. P. Principal loan amount. r. Monthly interest rate: Lenders provide you an annual rate so you'll need to divide that figure by 12 (the number of months in a year.

How To Calculate Your Monthly Mortgage Payment Given The Principal, Interest Rate, & Loan Period

The monthly payment would be $3,033.19 throughout the duration of the loan. In the first payment $1,666.67 would go toward interest while $1,366.52 goes toward principal. In the final payment only $20.09 is spent on interest while $3,013.12 goes toward principal. An amortization chart for this example is listed below. Payment Number.

Debt recovery interest calculator IrvinLindsay

You get a $300,000 mortgage with an interest rate of 6.25%, and you pay $7,000 in fees. The monthly principal and interest payment is $1,847.15. With fees added to the loan amount, the annual rate.

43+ how to calculate mortgage payment in excel FauveFinlaec

Mortgage payment calculator. This mortgage calculator will help you estimate the costs of your mortgage loan. Get a clear breakdown of your potential mortgage payments with taxes and insurance.

How To Calculate A Mortgage Payment Amount Mortgage Payments Explained With Formula YouTube

An interest-only mortgage is a type of loan where you only need to pay the interest portion of your loan principal—at first. In most cases, interest-only loans begin with a designated period.

How To Calculate Time In Loan Finance

Loan Term (in Years): 30 years. Interest Rate: 5.0%. Assuming you pay off the mortgage over the full 30 years, you will pay a total of $279,767.35 in interest over the life of the loan. That is almost the original loan amount! If we compare that to a 4.0% interest rate, the total interest paid would be $215,608.52.

How to calculate loan interest

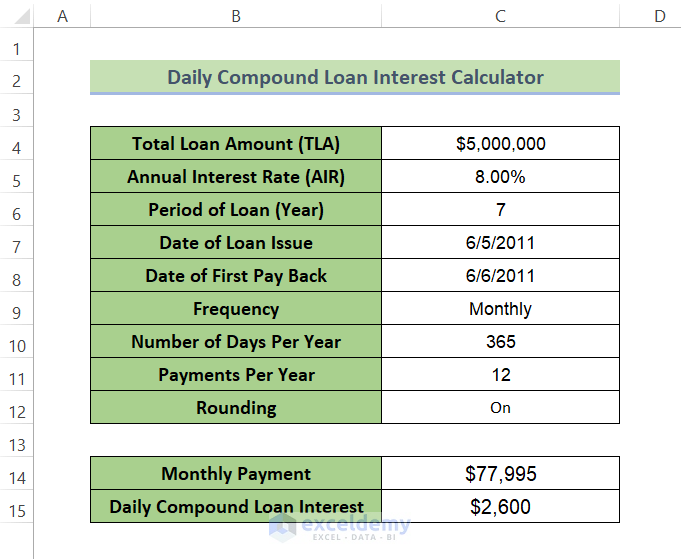

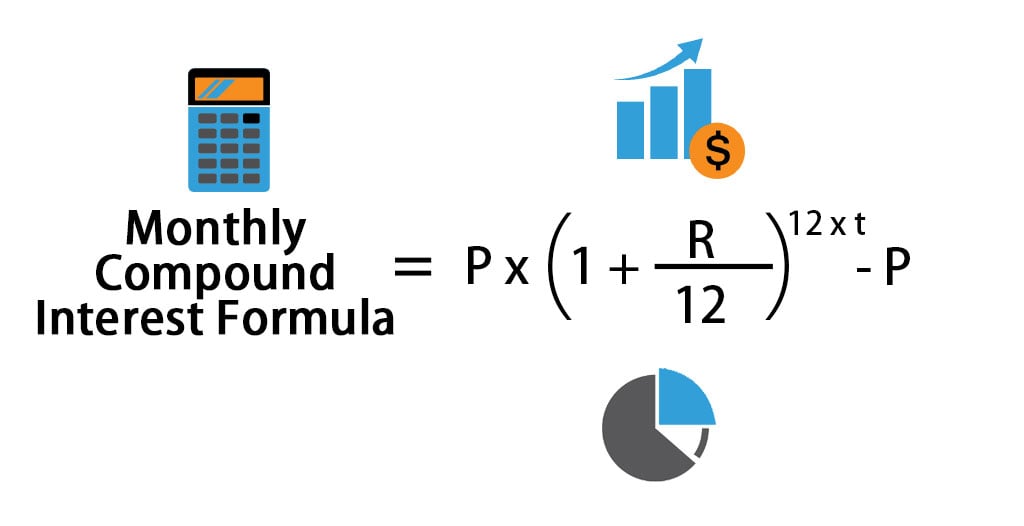

To calculate the amortized rate, complete the following steps: Divide your interest rate by the number of payments you make per year. Multiply that number by the remaining loan balance to find out.

Mortgage Fundamentals — an Illustrated Tutorial

The home loan term length that's right for you. 30-year fixed-rate mortgage lower your monthly payment, but you'll pay more interest over the life of the loan.

How To Calculate Home Loan Interest? Malaysia Housing Loan

The loan amount (P) or principal, which is the home-purchase price plus any other charges, minus the down payment; The annual interest rate (r) on the loan, but beware that this is not necessarily the APR, because the mortgage is paid monthly, not annually, and that creates a slight difference between the APR and the interest rate; The number of years (t) you have to repay, also known as the.

Calculate payment for a loan Excel formula Exceljet

5/53-4/54. $1,013. $25,319. $-0. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. There are options to include extra payments or annual percentage increases of common mortgage-related expenses. The calculator is mainly intended for use by U.S. residents.

How To Calculate Compound Interest On A Loan Monthly Info Loans

Subtract your principal from the total of your payments. This number will represent the total amount you will pay in interest over the life of your loan. For example, imagine you are paying $1,250 per month on a 15-year, $180,000 loan. Multiply $1,250 by your number of payments, 180 (12 payments per year*15 years), to get $225,000.

How To Calculate Loan Payments Using The PMT Function In Excel Excel tutorials, Excel hacks

If you have a variable interest rate, paying attention to the federal funds rate can help you predict what your interest rate will do. The amount you borrow. The more you borrow from your bank, the more interest you'll need to repay. For example, 5% of $1 million will always be a larger amount than 5% of $500,000. The outstanding loan amount.

Free Simple Interest Loan Calculator Google Sheets, Excel

Principal + Interest + Mortgage Insurance (if applicable) + Escrow (if applicable) = Total monthly payment. The traditional monthly mortgage payment calculation includes: Principal: The amount of money you borrowed. Interest: The cost of the loan. Mortgage insurance: The mandatory insurance to protect your lender's investment of 80% or more of.

.